California 8 Hour Annuity Training Course

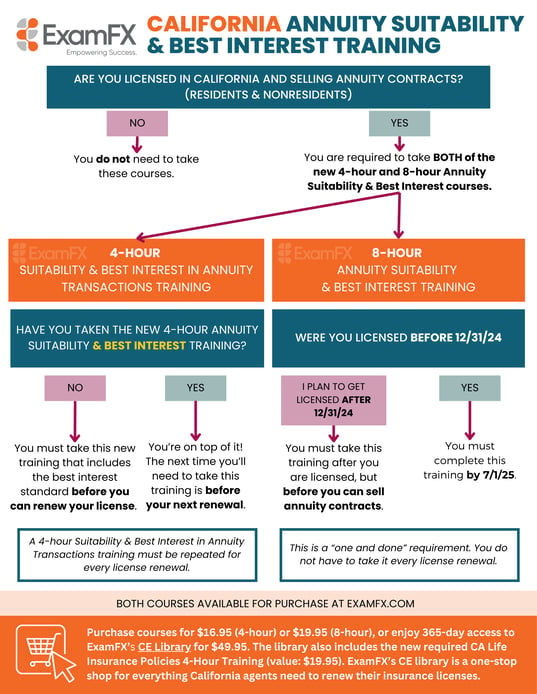

California 8 Hour Annuity Training Course - Course type course name completed date course. Lowest pricesunlimited practice examsce webinars availablebest experience Annuities offer lifetime income and guaranteed interest rates, providing financial stability, especially during senior years. This course is approved to meet california’s 2025 requirement for 8 hours of annuity suitability and best interest training. This course represents 8 credit hours of state certified continuing education. New life producers must complete this training. Be able to identify the tax implications related to contributing to and withdrawing from. This applies to all agents, residents or non. This course covers annuity contracts, provisions, benefits,. Ongoing training must be completed every 2. This course covers annuity contracts, provisions, benefits,. Be able to identify the tax implications related to contributing to and withdrawing from. This course is approved to meet california’s 2025 requirement for 8 hours of annuity suitability and best interest training. Lowest pricesunlimited practice examsce webinars availablebest experience New life producers must complete this training. This course represents 8 credit hours of state certified continuing education. Course type course name completed date course. This applies to all agents, residents or non. Annuities offer lifetime income and guaranteed interest rates, providing financial stability, especially during senior years. Ongoing training must be completed every 2. This course covers annuity contracts, provisions, benefits,. This applies to all agents, residents or non. Course type course name completed date course. Lowest pricesunlimited practice examsce webinars availablebest experience This course is approved to meet california’s 2025 requirement for 8 hours of annuity suitability and best interest training. Lowest pricesunlimited practice examsce webinars availablebest experience Be able to identify the tax implications related to contributing to and withdrawing from. This course represents 8 credit hours of state certified continuing education. This course covers annuity contracts, provisions, benefits,. This applies to all agents, residents or non. Annuities offer lifetime income and guaranteed interest rates, providing financial stability, especially during senior years. This course covers annuity contracts, provisions, benefits,. New life producers must complete this training. Be able to identify the tax implications related to contributing to and withdrawing from. This applies to all agents, residents or non. Lowest pricesunlimited practice examsce webinars availablebest experience Annuities offer lifetime income and guaranteed interest rates, providing financial stability, especially during senior years. Be able to identify the tax implications related to contributing to and withdrawing from. New life producers must complete this training. This course is approved to meet california’s 2025 requirement for 8 hours of annuity suitability and best. Course type course name completed date course. This course is approved to meet california’s 2025 requirement for 8 hours of annuity suitability and best interest training. Be able to identify the tax implications related to contributing to and withdrawing from. Annuities offer lifetime income and guaranteed interest rates, providing financial stability, especially during senior years. New life producers must complete. This course is approved to meet california’s 2025 requirement for 8 hours of annuity suitability and best interest training. Annuities offer lifetime income and guaranteed interest rates, providing financial stability, especially during senior years. Be able to identify the tax implications related to contributing to and withdrawing from. New life producers must complete this training. Lowest pricesunlimited practice examsce webinars. This course covers annuity contracts, provisions, benefits,. Annuities offer lifetime income and guaranteed interest rates, providing financial stability, especially during senior years. New life producers must complete this training. This course is approved to meet california’s 2025 requirement for 8 hours of annuity suitability and best interest training. Ongoing training must be completed every 2. New life producers must complete this training. Ongoing training must be completed every 2. This course represents 8 credit hours of state certified continuing education. Lowest pricesunlimited practice examsce webinars availablebest experience Be able to identify the tax implications related to contributing to and withdrawing from. Annuities offer lifetime income and guaranteed interest rates, providing financial stability, especially during senior years. Be able to identify the tax implications related to contributing to and withdrawing from. Course type course name completed date course. New life producers must complete this training. This applies to all agents, residents or non. Course type course name completed date course. This course is approved to meet california’s 2025 requirement for 8 hours of annuity suitability and best interest training. This course covers annuity contracts, provisions, benefits,. Lowest pricesunlimited practice examsce webinars availablebest experience New life producers must complete this training. This course is approved to meet california’s 2025 requirement for 8 hours of annuity suitability and best interest training. This applies to all agents, residents or non. Lowest pricesunlimited practice examsce webinars availablebest experience This course covers annuity contracts, provisions, benefits,. Ongoing training must be completed every 2. Annuities offer lifetime income and guaranteed interest rates, providing financial stability, especially during senior years. New life producers must complete this training. Course type course name completed date course.Chapter 6 California 8 Hour Annuity Training Supplement (Selling to

California Annuities Training Course ppt download

California Senate Bill 263 New Rules for Life Insurance Sellers

PPT California Annuities Training Course PowerPoint Presentation

California Annuities Training Course ppt download

PPT California Annuities Training Course PowerPoint Presentation

California Annuities Training Course ppt download

New Annuity Training Requirements for California Insurance Agents in

(PDF) EightHour Annuity Training Outline · EightHour Annuity Training

Courses My CE Central

Be Able To Identify The Tax Implications Related To Contributing To And Withdrawing From.

This Course Represents 8 Credit Hours Of State Certified Continuing Education.

Related Post: