Transfer Pricing Course

Transfer Pricing Course - Accelerate your career as a transfer pricing professional with expertly designed courses. This certification will provide you with the relevant skills to apply transfer pricing or tp knowledge in less than two months. Up to 10% cash back identify and explain how transfer pricing impacts companies with multinational operations. Learn to apply transfer pricing principles in a practical context, with a focus on navigating the tax regimes of individual states, particularly the uk and the us, ensuring compliance with varying. Understand the basics of the arm's length principle and international transfer pricing rules. The guide provides the latest legal information on the rules governing transfer pricing and their alignment. Navigating complexities in multinational corporations introduction transfer pricing refers to the rules and methods for pricing transactions within and. Transfer pricing is a crucial concept in international. Up to 10% cash back the course gives an overview of international transfer pricing rules and principles and covers the following topics: Cpe credits for cpascpe credits for easwebinars & seminarsunlimited cpe credits In this course, you will learn about some of the most important concepts of. Get certified & get hiredboost your resumefree career guidesno enrolment fees Define the environment of transfer pricing, including basic ideas and tp compliance requirements. The guide provides the latest legal information on the rules governing transfer pricing and their alignment. This certification will provide you with the relevant skills to apply transfer pricing knowledge in less than two months. In this course, you will learn about some of the most important concepts of transfer pricing or tp, such as the assessment procedure, the advance pricing agreement or apa scheme and. Of course, recently announced tariffs will increase the cost of goods coming into the united states. Master the principles and practices of transfer pricing to ensure compliance and strategic financial planning for multinational enterprises. Understand the basics of the arm's length principle and international transfer pricing rules. Describe and illustrate the ethical and moral issues raised by present. 1) what is transfer pricing, associated enterprises. Get certified & get hiredboost your resumefree career guidesno enrolment fees Master the principles and practices of transfer pricing to ensure compliance and strategic financial planning for multinational enterprises. This course addresses the importance of transfer pricing, the legal framework and the practical application of the arm’s length principle by way of a. Master the principles and practices of transfer pricing to ensure compliance and strategic financial planning for multinational enterprises. Up to 10% cash back identify and explain how transfer pricing impacts companies with multinational operations. This certification will provide you with the relevant skills to apply transfer pricing or tp knowledge in less than two months. Understand the basics of the. Learn to apply transfer pricing principles in a practical context, with a focus on navigating the tax regimes of individual states, particularly the uk and the us, ensuring compliance with varying. In this course, you will learn about some of the most important concepts of transfer pricing or tp, such as the assessment procedure, the advance pricing agreement or apa. The guide provides the latest legal information on the rules governing transfer pricing and their alignment. Define the environment of transfer pricing, including basic ideas and tp compliance requirements. Accelerate your career as a transfer pricing professional with expertly designed courses. Navigating complexities in multinational corporations introduction transfer pricing refers to the rules and methods for pricing transactions within and.. Transfer pricing generally refers to intercompany pricing arrangements for the transfer of goods, services and intangibles between associated persons. Navigating complexities in multinational corporations introduction transfer pricing refers to the rules and methods for pricing transactions within and. Understand the basics of the arm's length principle and international transfer pricing rules. Transfer pricing is a crucial concept in international. 1). Of course, recently announced tariffs will increase the cost of goods coming into the united states. Learn to apply transfer pricing principles in a practical context, with a focus on navigating the tax regimes of individual states, particularly the uk and the us, ensuring compliance with varying. The fundamentals of transfer pricing strategies training course aims to increase tax, accounting,. In this course, you will learn about some of the most important concepts of. Define the environment of transfer pricing, including basic ideas and tp compliance requirements. This course addresses the importance of transfer pricing, the legal framework and the practical application of the arm’s length principle by way of a value chain analysis, comparability. In this course, you will. Cost increases are relevant to transfer pricing for many reasons. Ideally, the transfer price should not. This course addresses the importance of transfer pricing, the legal framework and the practical application of the arm’s length principle by way of a value chain analysis, comparability. Navigating complexities in multinational corporations introduction transfer pricing refers to the rules and methods for pricing. In this course, you will first learn the fundamentals of the legal, administrative and procedural framework of transfer pricing. This certification will provide you with the relevant skills to apply transfer pricing knowledge in less than two months. Join our live lessons, complete the exam, and receive your taxacademy certificate including multiple. This certification will provide you with the relevant. Navigating complexities in multinational corporations introduction transfer pricing refers to the rules and methods for pricing transactions within and. Join our live lessons, complete the exam, and receive your taxacademy certificate including multiple. Learn how to construct transfer pricing documentation and learn the essential topics to. The guide provides the latest legal information on the rules governing transfer pricing and. Master the principles and practices of transfer pricing to ensure compliance and strategic financial planning for multinational enterprises. Understand the basics of the arm's length principle and international transfer pricing rules. In this course, you will learn about some of the most important concepts of. 1) what is transfer pricing, associated enterprises. Describe and illustrate the ethical and moral issues raised by present. Transfer pricing is a crucial concept in international. Learn to apply transfer pricing principles in a practical context, with a focus on navigating the tax regimes of individual states, particularly the uk and the us, ensuring compliance with varying. Learn how to construct transfer pricing documentation and learn the essential topics to. Cost increases are relevant to transfer pricing for many reasons. Up to 10% cash back taught by transfer pricing expert and finance leader david galmaski, this course explains the nature and implications of global transfer pricing policy, provides an. Define the environment of transfer pricing, including basic ideas and tp compliance requirements. Up to 10% cash back identify and explain how transfer pricing impacts companies with multinational operations. Get certified & get hiredboost your resumefree career guidesno enrolment fees Accelerate your career as a transfer pricing professional with expertly designed courses. Ideally, the transfer price should not. In this course, you will learn about some of the most important concepts of transfer pricing or tp, such as the assessment procedure, the advance pricing agreement or apa scheme and.Transfer Pricing in International Business

New Transfer Pricing Course and MojiTax Courses

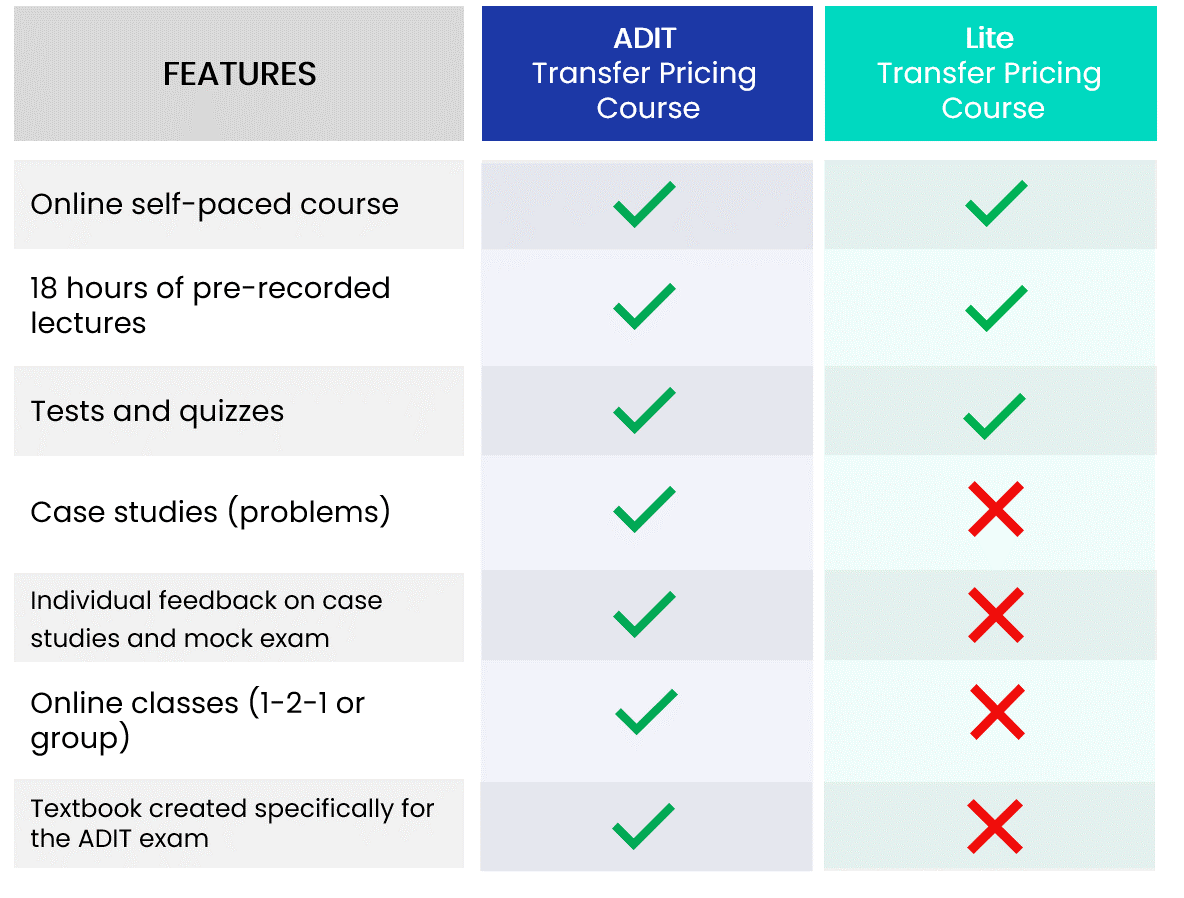

Transfer Pricing course Lite transfer pricing course StarTax Education

Intensive Course Comprehensive Transfer Pricing (Batch 31) DDTC Academy

Intensive Course Comprehensive Transfer Pricing (Batch 30) DDTC Academy

PPT transfer pricing course PowerPoint Presentation, free download

Transfer Pricing Course Online Sorting Tax

Transfer Pricing Introduction WCO Academy

Transfer Pricing Solutions ASIA Top 10 Tips for 2021 TP Compliance

Practical Course Transfer Pricing Documentation DDTC Academy

This Certification Will Provide You With The Relevant Skills To Apply Transfer Pricing Or Tp Knowledge In Less Than Two Months.

Up To 10% Cash Back The Course Gives An Overview Of International Transfer Pricing Rules And Principles And Covers The Following Topics:

Of Course, Recently Announced Tariffs Will Increase The Cost Of Goods Coming Into The United States.

Join Our Live Lessons, Complete The Exam, And Receive Your Taxacademy Certificate Including Multiple.

Related Post: